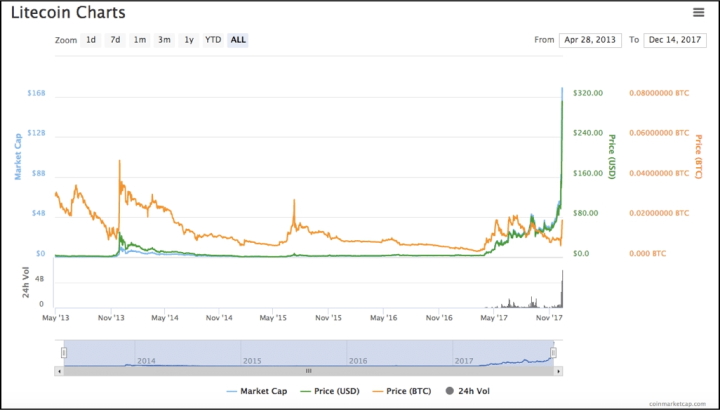

As more and more people embrace the world of cryptocurrencies, investors are looking for new investment opportunities beyond Bitcoin and Ethereum . Litecoin is one of the cryptocurrencies that is the right choice. Please note that since the beginning of 2017, the price of Litecoin has increased by 7,291%! By comparison, Bitcoin has risen 1,731% since then.

Anyway, in this guide we are going to take a deep dive into LTC. Let's find out how it works.

Content:

- Origin and creation of the Litecoin cryptocurrency.

- How does Litecoin cryptocurrency mining work?

- What is Scrypt and what is it for?

- How much faster are Litecoin cryptocurrency transactions compared to competitors?

- Why is Litecoin cryptocurrency immune to flood attacks?

- What is Atomic Swap and how does it work?

- Where to buy and store Litecoin cryptocurrency?

- Conclusion.

Origin and creation of the Litecoin cryptocurrency

While the identity of BTC creator Satoshi Nakamoto is shrouded in mystery, Litecoin creator Charlie Lee is very active on social media and his blog. Charlie Lee is a former Google employee who had the intention of creating a lighter version of Bitcoin.

If Bitcoin is seen as “digital gold” and a store of value for long-term purposes, then Litecoin is seen as “digital silver” and a means for cheaper transactions for everyday purposes.

LTC was released on October 7, 2011 through an open source client on GitHub. The Litecoin network was launched on October 13, 2011. Essentially, it is a fork of the Bitcoin Core client.

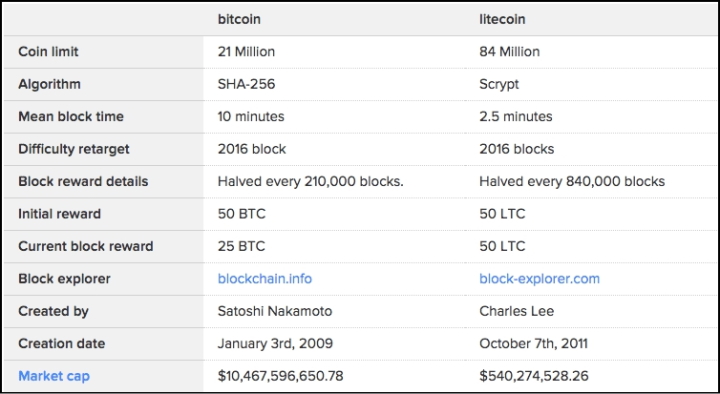

If we want to truly understand Litecoin, then comparison with Bitcoin is essential. LTC, by the creator’s own admission, is a clone of BTC.

How does Litecoin cryptocurrency mining work?

One of the most fundamental and technical differences between them is the procedure for extracting them. Both use a consensus mechanism to check functionality. The proof of work is quite simple to understand. Miners use their computing power to solve extremely complex cryptographic problems and equations. The complexity of new tasks is becoming increasingly higher, since if they are simple, then the miners will get all the Bitcoin coins as quickly as possible. But while solving the problem itself is difficult, checking whether the solution is correct should be simple. This is proof of work in simple words.

BTC uses the SHA-256 hashing algorithm for mining. After the difficulty of mining increased and it no longer made sense to mine coins from a regular computer, it was discovered that it was possible to increase mining power exponentially by forming mining pools using parallel processing. In parallel processing, software instructions are distributed among multiple processors. Thanks to this, the execution time of this program is significantly reduced.

Also, the greater complexity of Bitcoin mining has led to the emergence of specialized application integrated circuits such as ASICs. The only purpose ASICs serve is Bitcoin mining.

Mining, as Satoshi originally envisioned, was supposed to be very democratic. The idea was that anyone could use their laptop and contribute to the system by becoming a miner. However, with the increase in complexity and the advent of ASICs, the average user has no chance against large companies.

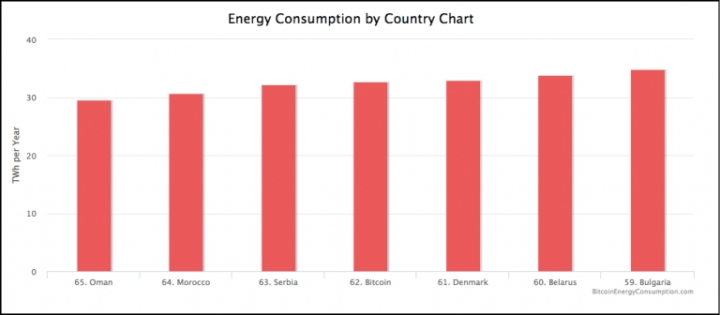

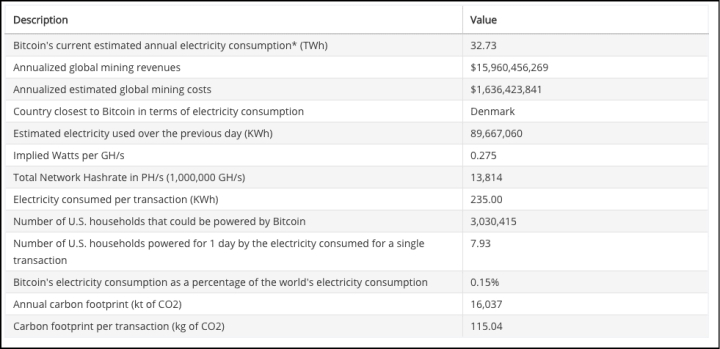

On top of everything else, mining is an extremely wasteful process. The amount of electricity lost during mining is enormous. Here's how much energy BTC mining consumes:

Bitcoin consumes 32.73 TW of energy annually! This is almost as much as Denmark consumes, and more than Oman, Morocco and Serbia:

On top of this, the effects that mining can have on the environment are potentially very devastating.

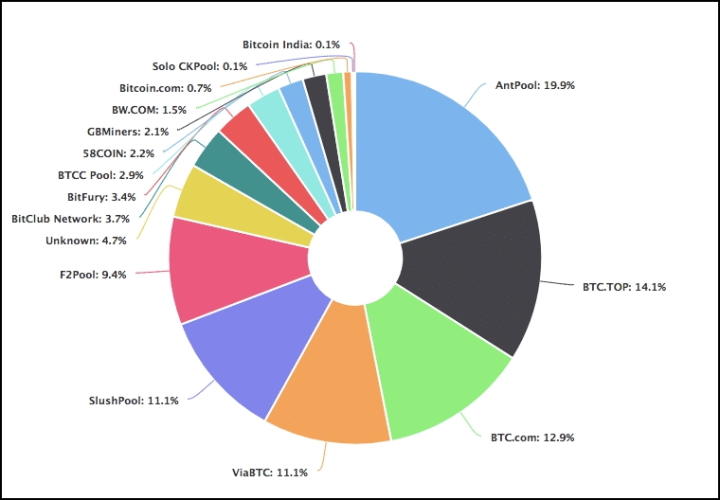

Building on the first point, another important issue is currency centralization. Currently, more than 50% of Bitcoins use only five mining pools. If any pool ever manages to get 51% of the hashrate, then it can launch an attack on the Bitcoin blockchain. Thus, to combat these problems, Litecoin uses the Scrypt algorithm.

What is Scrypt and what is it for?

Scrypt was originally called "S-crypt", but was pronounced "Script". Although this algorithm actually uses the SHA-256 algorithm, its calculations are much more structured than BTC's SHA-256. Thus, parallel computing is not possible.

For example, let's say we have two processes - A and B. In Bitcoin mining, ASICs will be able to simultaneously execute processes A and B (in parallel). And in mining the Litecoin cryptocurrency, you will need to do A first, and then B, and nothing else. If you try to run two processes at once, as in Bitcoin mining, the memory required becomes too large to handle.

Scrypt is also called the "memory problem" because the main limiting factor is not raw processing power, but memory. It is for this reason that parallelism becomes an unsolvable problem. Running 5 processes in parallel requires 5 times more memory. Of course, there are now devices with huge amounts of memory, but there are two factors that mitigate this:

- Ordinary people can buy simple memory cards instead of specialized ASICs.

- Memory cards are much more expensive to produce than SHA-256 hashing chips.

Scrypt was specifically designed to make mining accessible and democratic. However, recently companies like Zeus and Flower Technology could create ASICs with Scrypt technology. But then, unfortunately, this would mean the death of democratic mining.

How much faster are Litecoin cryptocurrency transactions compared to competitors?

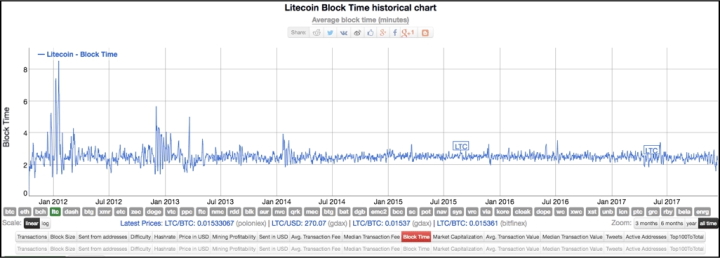

The average block mining speed for Litecoin is 2.5 minutes compared to 10 minutes for Bitcoin. The graph shows the block creation time for LTC:

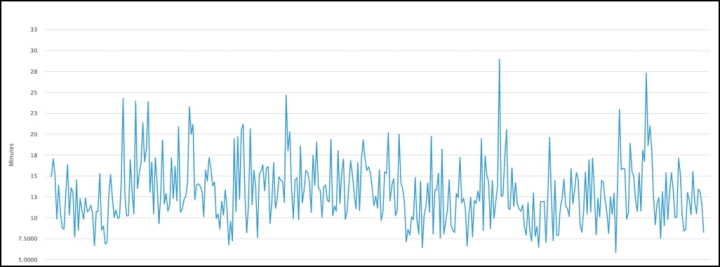

Due to network congestion and slow block mining times, the average transaction waiting time can stretch up to 29 minutes:

This feature is extremely useful for users who need to make many mini-transactions per day. Using Litecoin, they can receive two confirmations within 5 minutes, while only one confirmation on the Bitcoin network will take at least 10 minutes.

Another major benefit of faster block creation is the difference in block rewards. Since the time between blocks is very short, more and more miners are able to mine blocks and receive mining rewards. This means that, in theory, mining rewards should be more well distributed in Litecoin, and therefore should be more decentralized. However, there are some disadvantages that come with higher transaction speeds.

Firstly, since the block creation time is very short, this leads to the creation of more “lost” blocks. Mining in every sense is a competition between miners. There are miners and pools trying to mine the next block to be added to the chain. And there are times when two miners simultaneously solve the same problem. In such situations, the network decides which block should be added next. The second block becomes “lost”, that is, a block in which there will be no transactions.

In the Litecoin cryptocurrency, since there is very little downtime between blocks, the likelihood of miners mining “lost” blocks increases exponentially. "Lost" blocks are simply a leak in the system.

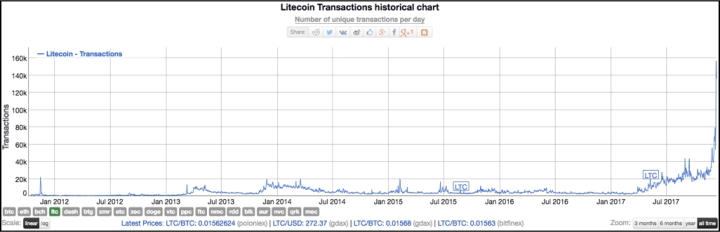

Secondly, there is a huge load on the blockchain. Look at the number of transactions happening on the LTC chain:

Even though Litecoin was created specifically for transaction volume, it still creates a huge load and clogs the blockchain.

This problem in the Litecoin cryptocurrency was solved using Segwit (Segregated Witnes). Let's look at what we mean using Bitcoin transactions as an example. For example, user "A" wants to send 0.0015 BTC to user "B", and to do this, he sends input worth 0.0015770 BTC. Leaving the complex explanations with the program code aside, let's get to the point, saying that when sending coins, the signature data of user “A” will be under the input data. And this signature data can cause two main problems:

- They can be easily manipulated, which can lead to transaction attacks.

- They eat up a lot of space in each block.

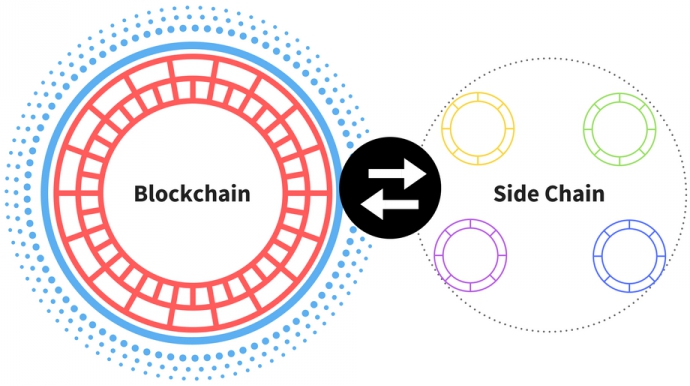

This is where Segwit technology comes to the rescue. The idea behind it is that you have a parallel circuit that runs along with the main circuit. The side chain will be attached to the main chain using a double-sided pin. This is what the initial idea of Blockstream (analogous to Segwit) looked like on the Bitcoin blockchain:

Thus, by removing signature data from transactions, the block space became empty and transactions became flexible, which significantly reduced the load on the Litecoin cryptocurrency network.

Why is Litecoin cryptocurrency immune to flood attacks?

In July 2015, the BTC network suffered a flood attack. A flood attack is an attack in which the network is flooded with spam transactions, which basically fill up the blocks and clog up the blockchain.

In this particular attack, the network was overwhelmed with thousands of transactions, and at one point there were approximately 80,000 transactions in the memory pool.

According to Charlie Lee, the Litecoin cryptocurrency protects itself from flood attacks by making such an attack as economically unprofitable as possible. The fix implemented in Litecoin is to charge the sender for every tiny output it creates. For example, in this particular attack, the sender was charged one fee for sending 34 tiny transfers of 0.00001 BTC. After the fix, this board became 34 times larger. Thus, for a spam attack it will cost the attacker much more.

What is Atomic Swap and how does it work?

One of the most interesting features that LTC cryptocurrency provides is “Atomic Exchange”. Atomic exchange allows coins to be exchanged without the need for a third party. For example, if user "A" had 1 BTC and he wanted to receive 100 LTC in return from user "B", he would have to pay certain fees. With the introduction of "atomic exchange", they could simply trade their coins without going through an exchange or paying unnecessary transaction fees.

"Atomic Exchanges" work using "HTLC". "HTLC" allows you to open payment channels through which funds can be transferred between parties before a pre-agreed deadline. These payments are confirmed by providing cryptographic evidence. Along with this, another great feature of HTLC is that it allows the party to refuse the payment given to them and return it to the payer.

Where to buy and store Litecoin cryptocurrency?

Since this cryptocurrency is very popular, you can buy it on almost any cryptocurrency exchange . Here are some of them:

Since this cryptocurrency is very popular, you can buy it on almost any cryptocurrency exchange . Here are some of them:

When it comes to wallets for storing cryptocurrencies , there are many options that you can use. As an example:

- Hardware wallets.

- Desktop wallets.

- Mobile wallets.

- Online wallets.

- Paper wallets.

Conclusion

As it becomes clear, the Litecoin cryptocurrency was conceived as the “little brother” of Bitcoin. Over the past years, Litecoin has repeatedly taken the risks necessary to show the masses the true scale and potential of cryptocurrencies. The LTC cryptocurrency was one of the first to implement the Segwit protocol and Atomic Exchanges, which made its use much easier. Therefore, we can say with confidence that the growth of this coin was not empty, and that in the future we are likely to see a repetition of a significant increase in LTC prices.

See also:

To leave a comment, you must register or log in to your account.