Ripple is a commercial technology platform and cryptocurrency (XRP) developed by Ripple Labs. The company specializes in providing real-time payments and foreign exchange services to financial institutions such as banks and payment processors. More than 100 companies around the world have implemented Ripple software to ensure fast transactions.

Ripple is a commercial technology platform and cryptocurrency (XRP) developed by Ripple Labs. The company specializes in providing real-time payments and foreign exchange services to financial institutions such as banks and payment processors. More than 100 companies around the world have implemented Ripple software to ensure fast transactions.

As a result of this active adoption in the financial industry, XRP is now the third largest cryptocurrency after Bitcoin and Ethereum . Although you can buy XRP, this cryptocurrency is not intended for consumer use. But it is useful for large financial institutions and provides liquidity for banks, facilitating cross-border transfers.

Unlike most blockchain technologies, which are protected by a decentralized network of miners, Ripple is protected by a network of validating servers with an internal ledger that guarantee transactions based on consensus. Instead of mining rewards, all 100 billion Ripple coins were created at once, and Ripple Labs controls the distribution of all coins. There are approximately 40 billion XRP in circulation so far, and Ripple Labs will issue more coins as needed while controlling the money supply.

However, transactions are not limited to XRP coins only. Ripple also supports fiat currencies such as dollars, euros, pounds and yen. Ripple also includes support for cryptocurrencies such as Bitcoin and other valuable tokens such as frequent flyer miles or gold. Ripple is primarily about payment processing and currency exchange. In this sense, XRP does not seek to compete with BTC or ETH. Instead, it competes with prevailing payment and remittance confirmation systems such as Swift or ACH, and new technologies such as Payoneer. Ripple offers speed and security to the $155 trillion cross-border payments industry.

Content:

- About the Ripple cryptocurrency in simple words.

- History of the development of the Ripple cryptocurrency and the development team.

- What problems does the Ripple cryptocurrency solve?

- Why does the Ripple cryptocurrency need xCurrent and what is it?

- What are xRapid and xVia?

- The technical side of the Ripple cryptocurrency.

- Vulnerability, centralization and competition of the Ripple cryptocurrency.

- Conclusion.

About the Ripple cryptocurrency in simple words

Ripple is a reimagining of a very old idea that dates back to medieval times. There were no banks in those days, so if you wanted to send money from city to city, you had to go to a paying agent to help you send the money. And it was necessary that payment agents trust each other.

Ripple is a reimagining of a very old idea that dates back to medieval times. There were no banks in those days, so if you wanted to send money from city to city, you had to go to a paying agent to help you send the money. And it was necessary that payment agents trust each other.

Ripple works in a similar way, connecting payment agents to facilitate payments. In addition, the Ripple algorithm discovers a trusted path for transactions. If the third agent trusts both your agent and your friend's agent, then the third party can act as an intermediary between them. In Ripple, agents are called “gateways,” which are most often banks or other financial institutions.

But it doesn't have to be cash only. In theory, this trusted gateway system can work with anything. You can send a piece of gold or a car, and your gateway can transfer these things to you, provided that it was equipped with everything necessary to trade gold or cars. The advantage of Ripple is its ability to carry out any transaction, especially across multiple currencies simultaneously, and IOUs between agents/gateways are recorded on the XRP ledger and can be resolved in real time.

History of the development of the Ripple cryptocurrency and the development team

Development of Ripple began in 2012, but the idea originated back in 2004. In 2005, Ryan Fugger launched RipplePay.com. RipplePay provided secure online payment methods for communities, but was not widely adopted. In 2011, Fugger was soon approached by Jared McCaleb and Chris Larsen with a request to replace RipplePay with a digital currency system in which transactions are verified by a community based on consensus, rather than by miners, as in the BTC network.

Work on the Ripple Transaction Protocol began in 2012. The protocol was designed to facilitate fast direct money transfers between two parties in fiat currencies without the wait time or transaction fees of traditional money transfer services. To provide greater liquidity, the protocol also included the creation of a new token known as XRP.

By 2014, what started as a person-to-person money transfer option began to gain traction with banks as another option for settling money transfers in a faster and more cost-effective manner. In 2014, several banks and payment processors signed a contract to use XRP for testing. Since then, Ripple has been adding more institutions with over 100 clients in 2017.

It is important to note that XRP is a private company. They have raised funding through institutional investors and venture capital, and their revenue model is based on professional services and creating RippleNet integrations for financial institutions. Since 2017, XRP has had a positive monetary outcome.

What problems does the Ripple cryptocurrency solve?

In an era of constant and instantaneous development, financial institutions are still using technologies developed in the 1970s to make payments. Banks and payment systems charge high fees for cross-border transfers and processing takes several days. As a result, global trade and consumer behavior are not evolving at the same pace as technology. Reduced fees and processing times could lead to an explosion of globalization and cross-border cooperation, especially for small transfers that were previously impossible due to fees and exchange rates.

In an era of constant and instantaneous development, financial institutions are still using technologies developed in the 1970s to make payments. Banks and payment systems charge high fees for cross-border transfers and processing takes several days. As a result, global trade and consumer behavior are not evolving at the same pace as technology. Reduced fees and processing times could lead to an explosion of globalization and cross-border cooperation, especially for small transfers that were previously impossible due to fees and exchange rates.

While banks certainly enjoy lining their pockets with hefty transaction fees, there are reasons why cross-border transfers are currently so expensive and slow. Chief among these shortcomings is the practice of nostro/vostro accounts. Instead of using the agent/gateway model described above, the local bank will have an account with another foreign bank (nostro), and the foreign bank will have an account with the local bank (vostro). These accounts are used for transactions in two currencies and must be verified before transactions can be approved. Often a third correspondent bank will enter the equation to facilitate and verify the reconciliation process.

The indirect nature of nostro/vostro account reconciliation makes it costly and time-consuming. Additionally, there is no set standard for cross-border payments. Each bank must follow its own country's rules, and each bank has different processes for reviewing incoming overseas transactions.

Why does the Ripple cryptocurrency need xCurrent and what is it?

Ripple's ultimate goal is to make money move with the same ease and speed as information in the digital age. Ultimately, this means instant payments at low prices in currencies that people actually use in their daily lives. Instead of sticking its nose into the banking system, Ripple is committed to modernizing the underlying infrastructure that runs our banking system, making transactions faster and cheaper for the average user.

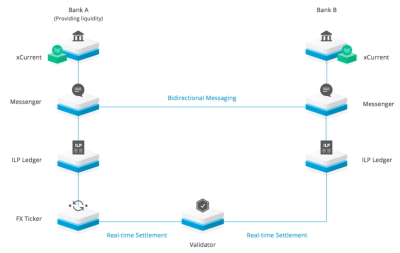

xCurrent is the first step in implementing global verification of XRP payments. xCurrent is enterprise software that allows banks to execute trades instantly. The technology also allows banks to review transaction information and resolve any compliance issues before authorizing a transaction. This allows for high forward processing speed and reduces the overhead of correcting or recovering failed transactions.

The payback for financial institutions is reduced costs and increased processing speed. If you make cross-border transactions instantly and cheaply, more customers will choose to use your bank's services, and the overall market for cross-border transactions will grow with every reduction in cost and time.

The payback for financial institutions is reduced costs and increased processing speed. If you make cross-border transactions instantly and cheaply, more customers will choose to use your bank's services, and the overall market for cross-border transactions will grow with every reduction in cost and time.

Many people wonder what makes Ripple different from a company like PayPal or Stripe in terms of payment processing. While PayPal and Stripe are aimed squarely at consumer solutions, Ripple operates more as an infrastructure for banks than as a standalone solution. Additionally, RippleNet does not rely on XRP to keep the company operating. If PayPal is closed, their payments will also be stopped. If Ripple goes out of business, RippleNet will continue to exist. Finally, PayPal still uses older technologies such as ACH to process its transactions. Ripple is a payment processing technology itself that integrates directly with banks and other partner gateway institutions, with faster processing times and lower fees than PayPal.

XRP also hopes to become an industry standard. Their server verification system is designed to act as a third-party authority that sets standards for cross-border transactions. Some banks may try to implement technology similar to Ripple, but ultimately the technology will be limited to the banks that created it and will be less useful compared to an international open source standard that any bank can join.

What are xRapid and xVia?

Ripple's newest projects, xRapid and xVia, are built on the xCurrent foundation.

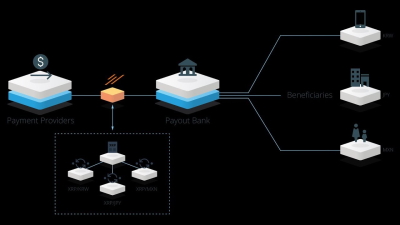

xRapid is a project aimed at helping payment processors enter emerging markets by reducing the amount of liquidity required to enter. For example, consider a payment system that wants to expand its operations to include Nairobi, one of the most important cities in East Africa. Such a payment processor must be willing to accept deposits in Kenyan shillings and have enough Kenyan shillings on hand to cover any payouts.

xRapid allows payment processors to receive this liquidity in the form of XRP instead of local currency, and Ripple partners with local financial institutions to complete the conversion from XRP to local currency. Since the liquidity is in XRP, it is easily transportable as Kenyan shillings, Japanese yen or Mexican pesos on demand.

xVia is an API that allows businesses, banks and payment processors to integrate with RippleNet to send payments. Along with these payments, senders may include extensive information such as invoices or supporting documentation. xVia is the connection between money and information for all types of payers.

The technical side of the Ripple cryptocurrency

RippleNet is an open source project and its cryptography is different from other cryptography projects. Unlike other blockchain projects, XRP relies on institutions to operate its network. While anyone can operate a node on the Ripple network, these trusted gateways (such as banks and other institutions) are the ones who facilitate transactions on Ripple, providing currency exchange, paper deposits, and other transfer facilities.

RippleNet is an open source project and its cryptography is different from other cryptography projects. Unlike other blockchain projects, XRP relies on institutions to operate its network. While anyone can operate a node on the Ripple network, these trusted gateways (such as banks and other institutions) are the ones who facilitate transactions on Ripple, providing currency exchange, paper deposits, and other transfer facilities.

Gateways accept deposits from individuals or institutions and issue balances on the XRP ledger. Gateways may also have their own requirements, such as Know Your Customer (KYC) and Anti-Money Laundering (AML), which require identifiable information about the individuals involved in the transaction. RippleNet operates as an infrastructure underneath these institutions, connecting them to each other to authorize payments and transfer funds.

Gateways on the network do not copy or create Ripple coins. In fact, all 100 billion XRP is pre-created. Since RippleNet does not use mining, transaction times can be very fast. Typically, payments between gateways take four seconds between start and finish. The Ripple network is capable of processing 1,500 transactions per second, far surpassing Bitcoin's 4 transactions per second or Ethereum's 15 transactions per second.

Since its coins are pre-created, the only incentive to join RippleNet and contribute computing power to the ledger is access to the system. Thus, most of XRP's hashing power is provided by institutional gateway users who use Ripple to process payments. RippleNet uses a consensus-based approach to creating a ledger, where each validating node compiles its own version of the next block based on the transactions it has received. Nodes compare their proposed blocks, and a new block is validated when a majority of nodes agree on the contents of the block.

Vulnerability, centralization and competition of the Ripple cryptocurrency

While Ripple's open source code is considered secure (banks wouldn't use it otherwise), it's important to note that Ripple's apparent centralization opens it up to attack. Although RippleNet will continue to exist even if the company closes, Ripple Labs controls the money supply on the network, limiting the viability of the network without control. The Purdue researchers also found that the use of gateways in XRP leaves some users vulnerable to having their funds blocked if the gateway disappears.

Another issue is Ripple's status as a private company. While the network itself is open source, the company running the network has financial goals for the project, and we can expect that company to listen to the needs of financial institutions (the company's clients) regarding the concerns of the average user.

Another issue is Ripple's status as a private company. While the network itself is open source, the company running the network has financial goals for the project, and we can expect that company to listen to the needs of financial institutions (the company's clients) regarding the concerns of the average user.

Conclusion

As it becomes clear, Ripple has become widespread in the financial sector, where there is no other cryptocurrency. It deserves its place as one of the top cryptocurrencies and cryptotechs to watch in the coming years. This could very well transform the global payments industry, but do not forget that this coin is completely centralized and you should not invest all your funds in it.

See also:

How to choose a wallet for storing Bitcoin and other cryptocurrencies

To leave a comment, you must register or log in to your account.